Payments

A payment tracks all details of the money received including the amount, date, and payment method.

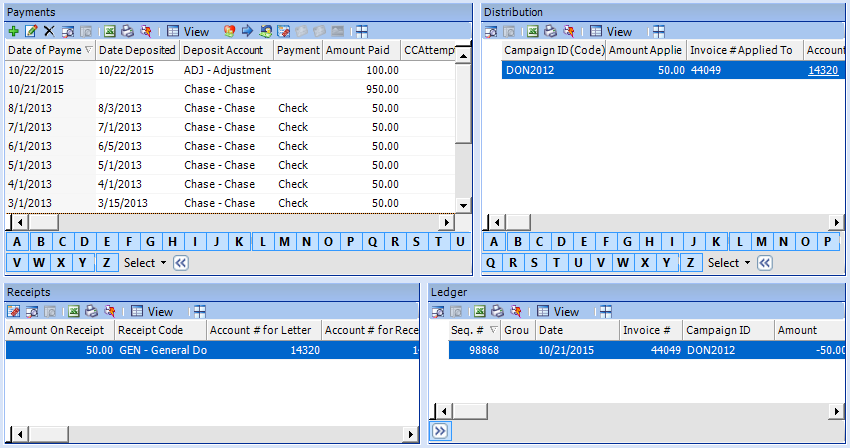

The Payments form:

The form is accessed from the Financials category in the Forms panel.

The form displays four panels:

Payments - displays the list of payments credited or given by the account, including payment amount, date, and bank.

For each payment record selected in the Payments grid, the information in each of the three remaining panels will display accordingly.

Distribution - displays the distribution information of the selected payment including the pledge(s) and campaign(s) toward which the payment was applied and the amounts. A payment may have multiple distributions.

Receipts - displays the receipt information for the selected payment, including the receipt type and amount.

Ledger - displays all the changes logged to the selected payment.

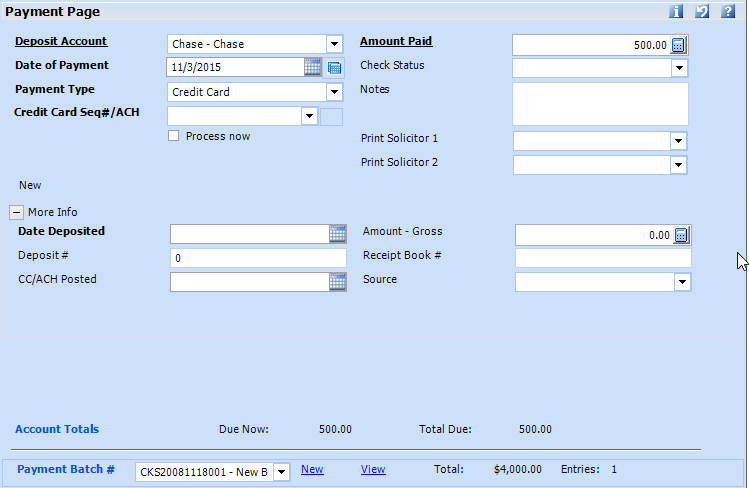

This page can be accessed from the Add Payment wizard. It contains all the information regarding the payment.

| Field Name | Description |

| Deposit Account | Also referred to as Bank, this is the designation of where the money will ultimately be deposited or assigned. It may be an actual bank account or a general description such as adjustment or credit for non-monetary credits towards the account's pledge. |

| Date of Payment | The date the payment was made.

If it is a check, enter the date of the check, not the current

date; the system will automatically log the date is was entered.

The scheduler icon  enables

a series of post-dated payments to be easily entered. Click on

the scheduler to enter the number of payments to be created. They

can be adjusted on the Schedule

Details page of the payment wizard. This is commonly used

in scenarios where the account is paying off a large pledge, such

as Tuition, with multiple head-checks, each for the same amount,

or when paying for a scheduled pledge. enables

a series of post-dated payments to be easily entered. Click on

the scheduler to enter the number of payments to be created. They

can be adjusted on the Schedule

Details page of the payment wizard. This is commonly used

in scenarios where the account is paying off a large pledge, such

as Tuition, with multiple head-checks, each for the same amount,

or when paying for a scheduled pledge. |

| Payment Type | The method of payment.

The list of payment types may be filtered based on the deposit account selected above. Selecting a payment type that was set up in Tools > Code Setup > Financials > Payment Types to accept checks will enable the check # field. If a payment type was set up to accept credit cards, the Credit Card Seq #/ACH field will be enabled. |

| Check # / Credit Card Seq#/ACH | Check #:

If the payment type

selected above is a check type, the field will be enabled as Check #.

If the check number entered is numeric and was already entered on another payment for the same account, a message will display, alerting the user of a possible duplicate payment. The check number and payment information will be allowed to be saved. Credit Card Seq# / ACH: If the payment type selected above is a credit card type, the field will be enabled as Credit Card/ACH. Select a card from the dropdown of cards that the account already has in the system, or right-click and select Add New Card to enter a new one. Process Now: If paying by credit card, the option to process now will charge the card upon saving the payment. |

|

Amount Paid |

The payment amount.

The amount may be negative, in the case of a refund payment for example. |

| Check Status | Payments may be assigned a status such as hold. |

|

Notes |

Internal notes regarding the payment. These may be printed on select payment reports. |

|

Print Solicitor 1 Print Solicitor 2 |

The solicitor(s) credited for the payment. These may be defaulted from the pledge solicitors. |

| Date Deposited | The

date the payment was deposited in the bank.

If using the Make Deposit function, leave the date blank and it will be updated with the date of the deposit selected when the deposit is made. A deposit account can be set to default the deposit date in Tools > Code Setup >- Financials > Deposit Accounts - Default Deposit. This is commonly used on non-money banks such as adjustment or discounts in which the payment is not actually deposited into a bank. The date may also be manually entered or defaulted to the current date or the payment date, if not using the Make Deposit utility. |

| Deposit # | Will be updated with the system

deposit # from the Make

Deposit function.

This is used to group payments together by deposit. |

| CC/ACH Posted | The date the credit card or

account was charged.

This will get updated from the posting function. It should not be manually entered, as the payment will not be processed if there is a date already entered. |

| Amount - Gross | Gross amount of payment. May be used for give & get payments and is not necessary for standard payments or donations. |

| Receipt Book # |

This has no bearing or effect on 360°'s receipt functionality, but is used to track a receipt number that may be given outside the system, such as on a hard-copy receipt book. If this field is being used, the next receipt book number will default. When using alpha and numeric characters, the alpha characters will remain the same and the numeric will increase by 1. A warning message will display if the manual receipt number already exits. |

| Source | From where or how the payment was received. |

| Account Totals:

Due & Due Now |

Reflects the outstanding pledge

amounts for the current account for the campaigns the user has

security to view.

|

| Payment Batch # | The batch, or group of payments,

to which the payment belongs.

Separate batches may be created based on the user's preference, or all payments may be placed in the same batch if the feature is not being used. It is more popular to group payments by deposit number instead of by batches and this feature is not commonly used. |

|

Note The payment cannot be saved before applying it to a pledge, or creating a new donation. Proceed to the Distribution page.

|